Every year, tax season brings a mix of stress and anticipation for millions of Americans. While filing taxes is rarely enjoyable, the promise of a refund often makes the process worthwhile. The 2026 Income Tax Refund is especially important for households facing rising costs, tight budgets, and lingering financial pressure. For many families, this refund is not extra money—it is essential money.

Understanding how the 2026 Income Tax Refund works, when it may arrive, and what can delay it allows taxpayers to plan more effectively. Whether the refund is used to pay bills, reduce debt, build savings, or cover planned expenses, timing matters. Knowing what to expect helps households avoid uncertainty and financial disruption.

Why the 2026 Income Tax Refund Matters So Much This Year

For millions of Americans, the 2026 Income Tax Refund plays a critical role in household finances. Many families structure their annual budgets around the expectation of receiving a refund during the first part of the year. This is especially true for lower- and middle-income households that rely on refunds to catch up after the holiday season.

January and February often bring financial pressure. Credit card balances from holiday spending become due, utility bills remain high in winter months, and routine costs like rent, groceries, insurance, and childcare continue without pause. The 2026 Income Tax Refund can provide timely relief during this period.

For some taxpayers, the refund represents the largest single payment they receive all year. That makes understanding the process behind the 2026 Income Tax Refund even more important.

When the IRS Started Processing Returns for the 2026 Income Tax Refund

The Internal Revenue Service officially began accepting and processing tax returns for the 2025 tax year in late January 2026. This marked the beginning of the refund cycle tied to the 2026 Income Tax Refund.

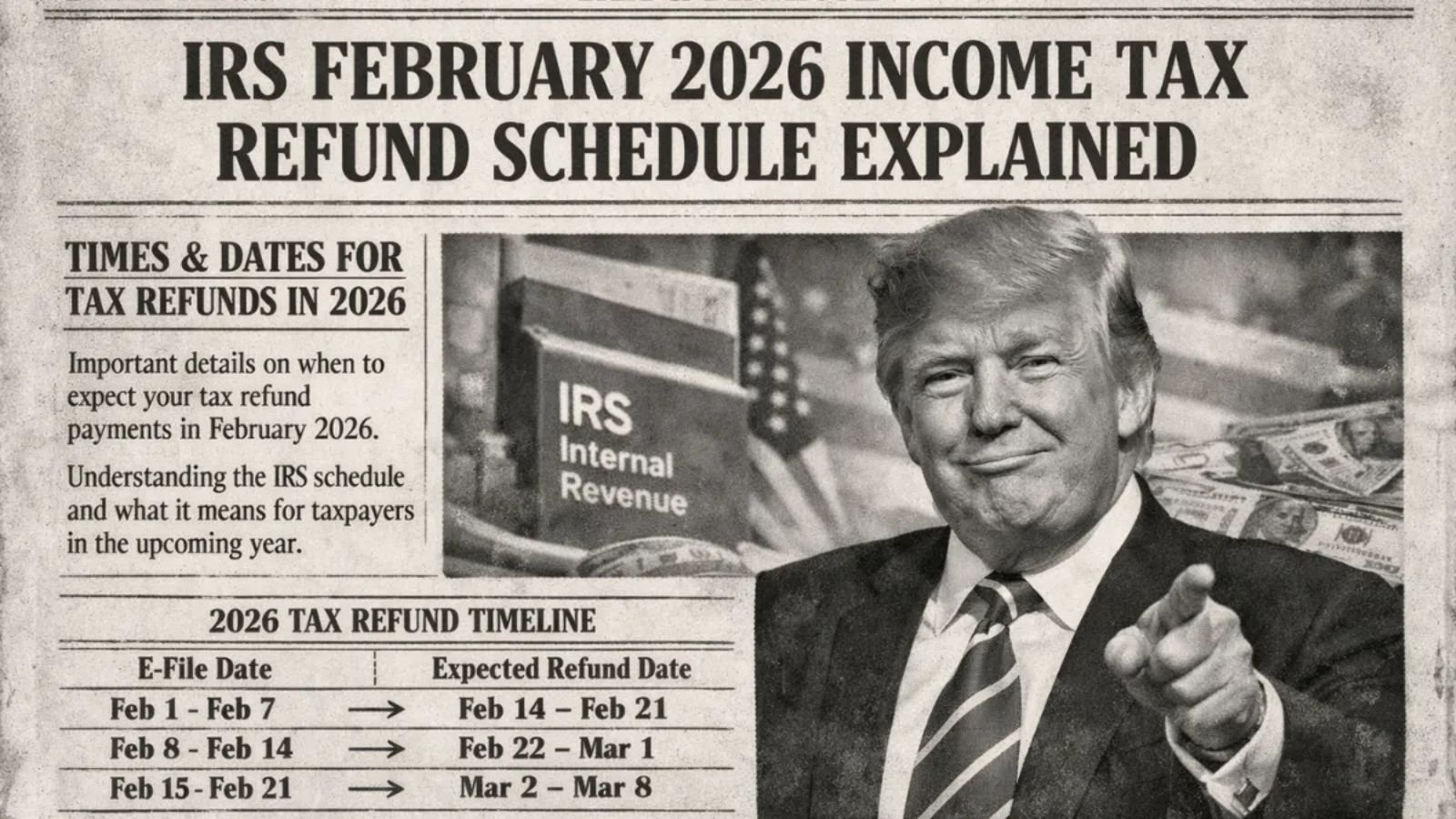

Once a return is accepted, the IRS begins verifying income data, credits, deductions, and identity information. For most taxpayers who file electronically and choose direct deposit, the 2026 Income Tax Refund is typically issued within about 21 days after acceptance.

Electronic filing allows tax information to move quickly through automated systems, reducing manual handling. Direct deposit further speeds up delivery by eliminating mailing time and check processing.

How Filing Method Affects the 2026 Income Tax Refund Timeline

One of the most important factors influencing when a taxpayer receives their 2026 Income Tax Refund is how the return is filed. Electronic filing is significantly faster than paper filing.

Returns filed electronically are processed through automated IRS systems that verify information quickly. In contrast, paper returns must be manually opened, reviewed, and entered, which can add weeks to processing time. Taxpayers who file by mail often wait much longer for their 2026 Income Tax Refund.

Choosing direct deposit is another key decision. Refunds sent via direct deposit typically arrive days or even weeks earlier than paper checks. Taxpayers who want the fastest possible 2026 Income Tax Refund generally benefit from e-filing combined with direct deposit.

Why Some 2026 Income Tax Refunds Are Delayed Until Mid or Late February

Not all taxpayers receive their 2026 Income Tax Refund within the standard 21-day window. Federal law requires the IRS to hold refunds that include certain credits, specifically the Earned Income Tax Credit and the Additional Child Tax Credit.

These credits are designed to support working families and households with dependents, but they are also more vulnerable to fraud. As a result, the IRS must conduct additional verification before releasing refunds that include these credits.

For taxpayers who claim these benefits, the 2026 Income Tax Refund is typically not released until at least mid-February. In many cases, funds arrive later in February rather than early in the month. This delay applies even if the return is filed early and electronically.

Common Issues That Can Slow Down a 2026 Income Tax Refund

While most refunds are processed smoothly, certain issues can delay a 2026 Income Tax Refund. Errors in personal information are among the most common causes. A misspelled name, incorrect Social Security number, or mismatched filing status can trigger additional review.

Income discrepancies also cause delays. If the income reported on a return does not match information submitted by employers or financial institutions, the IRS may pause processing. Missing documents, incomplete forms, or math errors can also affect the timing of the 2026 Income Tax Refund.

Identity verification checks are another factor. If the IRS suspects identity theft or fraud, it may require additional confirmation before releasing the refund. While these steps protect taxpayers, they can extend processing time.

Tracking the Status of Your 2026 Income Tax Refund

Taxpayers do not have to guess where their refund stands. The IRS provides official tracking tools that allow individuals to monitor the status of their 2026 Income Tax Refund.

Refund tracking information usually becomes available about 24 hours after an electronic return is filed and accepted. For paper returns, tracking may not appear for around four weeks. The system typically shows three stages: return received, refund approved, and refund sent.

Updates are made daily, usually overnight. Checking the status of a 2026 Income Tax Refund too frequently during the same day will not produce new information. The IRS advises patience, especially during peak filing season.

System Improvements and What They Mean for the 2026 Income Tax Refund

For the 2026 tax season, the IRS has continued efforts to modernize its systems. These upgrades aim to improve accuracy, reduce processing errors, and shorten wait times where possible. Many taxpayers who file early and electronically may experience smoother processing of their 2026 Income Tax Refund compared to previous years.

However, system improvements do not eliminate all delays. Returns that require manual review or additional verification may still take longer. The IRS generally recommends contacting them only if more than 21 days have passed since e-filing or more than six weeks since mailing a return.

Understanding these timelines helps manage expectations around the 2026 Income Tax Refund.

Smart Planning for Your 2026 Income Tax Refund

Receiving a 2026 Income Tax Refund can be an opportunity to improve financial stability if used thoughtfully. Many households use refunds to pay down high-interest debt, such as credit cards or personal loans. Reducing debt can lower monthly payments and save money on interest over time.

Others apply the 2026 Income Tax Refund toward essential expenses like rent, utilities, healthcare, or car repairs. For families who have fallen behind, catching up on bills can provide immediate relief.

Building or strengthening an emergency fund is another common use. Even setting aside a small portion of the 2026 Income Tax Refund can create a safety net for unexpected expenses later in the year.

Filing Early: One of the Best Ways to Get the 2026 Income Tax Refund Faster

Filing early remains one of the most effective ways to receive the 2026 Income Tax Refund as quickly as possible. Early filing reduces competition within IRS systems and allows more time to resolve potential issues before peak season.

Reviewing the return carefully before submission also matters. Double-checking personal information, income figures, and bank details can prevent errors that delay the 2026 Income Tax Refund.

Choosing direct deposit, filing electronically, and responding promptly to any IRS requests all contribute to faster processing.

Understanding Expectations Around the 2026 Income Tax Refund

While many refunds are issued within three weeks, not every 2026 Income Tax Refund follows the same timeline. Allowing extra time for reviews, especially when claiming credits, is realistic and wise.

Taxpayers who understand the process are less likely to feel anxious or frustrated. Knowing what can delay a 2026 Income Tax Refund helps set reasonable expectations and encourages proactive planning.

Final Thoughts on the 2026 Income Tax Refund

The 2026 Income Tax Refund represents more than just a payment—it is a financial reset for many households. Whether it is used to pay bills, reduce debt, or build savings, the refund can provide meaningful support during a financially demanding time of year.

By filing early, choosing electronic methods, and staying informed through official resources, taxpayers can increase their chances of receiving their 2026 Income Tax Refund smoothly and on time. While no system is perfect, preparation and patience go a long way.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. Details related to the 2026 Income Tax Refund, including timing and eligibility, depend on individual circumstances and official IRS processing guidelines. Always refer to official IRS resources or consult a qualified tax professional for personalized advice.