The topic of IRS Tax Refund 2026 is gaining significant attention as millions of Americans begin preparing for the upcoming tax season while also managing their Social Security and disability benefits. Every year, taxpayers eagerly wait for their refund payments because these funds often help cover essential expenses, reduce debt, or support household financial planning. The anticipation surrounding IRS Tax Refund 2026 is especially strong because many households are still adjusting to inflation, rising healthcare costs, and everyday living expenses.

The IRS Tax Refund 2026 process is managed by the Internal Revenue Service, which follows a structured system to review tax returns, verify eligibility, and issue refunds. At the same time, many Americans receiving benefits from the Social Security Administration closely monitor how their tax refunds may align with Social Security payments. Understanding how IRS Tax Refund 2026 works alongside benefit payment schedules can help families plan their finances more confidently and avoid confusion during tax season.

IRS Tax Refund 2026 and Its Importance for Household Financial Stability

For many households, the IRS Tax Refund 2026 is not simply extra income. It often represents money that taxpayers overpaid throughout the year or credits they qualified for through government programs. Families frequently depend on the IRS Tax Refund 2026 to cover overdue bills, pay rent, handle medical expenses, or invest in education and household improvements.

The growing cost of fuel, groceries, and utilities has made the IRS Tax Refund 2026 even more valuable. Many middle-income and low-income households rely on this refund as a financial reset. Tax credits such as the Earned Income Tax Credit and Child Tax Credit can significantly increase the IRS Tax Refund 2026, giving working families additional support during financially challenging times.

Another important aspect of the IRS Tax Refund 2026 is that it allows taxpayers to catch up on financial responsibilities they may have postponed. Some families use the refund to reduce credit card debt or build emergency savings, helping them stay financially secure throughout the year.

How IRS Tax Refund 2026 Is Processed and Scheduled

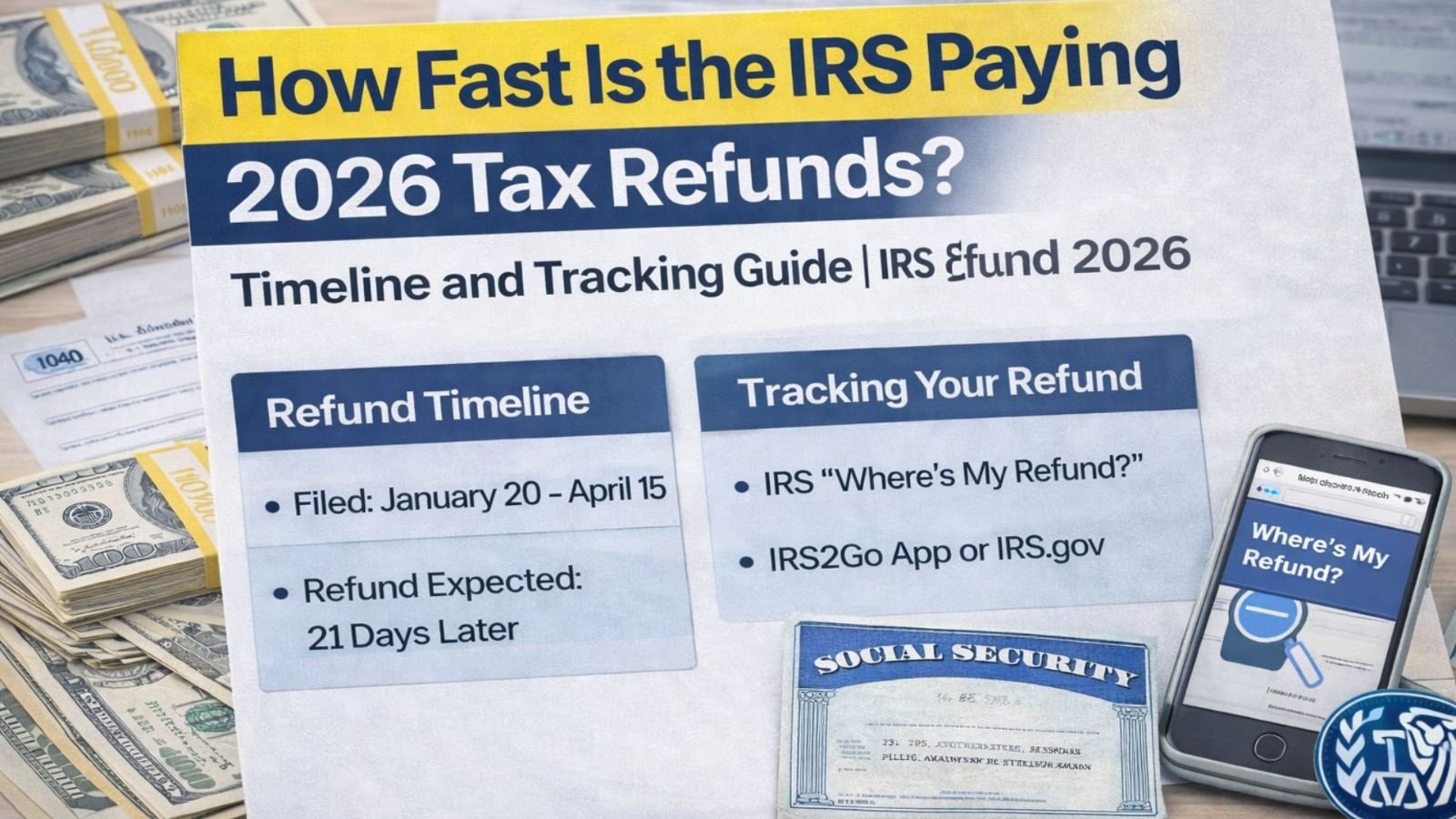

The timeline for receiving the IRS Tax Refund 2026 depends on how and when taxpayers file their returns. The tax filing season usually begins in late January, and the IRS Tax Refund 2026 is typically issued within 21 days for electronically filed returns with direct deposit selected. Paper returns can take significantly longer due to manual processing requirements.

Taxpayers expecting the IRS Tax Refund 2026 should ensure that all information provided on their tax return is accurate. Errors such as incorrect Social Security numbers, mismatched income records, or missing forms can delay the IRS Tax Refund 2026. Filing early and choosing direct deposit is often recommended because it reduces processing time and minimizes the risk of lost or delayed payments.

Another factor affecting the IRS Tax Refund 2026 timeline is fraud prevention screening. The Internal Revenue Service carefully reviews returns to prevent identity theft and fraudulent claims. While this screening helps protect taxpayers, it may extend the waiting period for certain refunds.

Connection Between IRS Tax Refund 2026 and Social Security Benefits

Many retirees and individuals receiving disability benefits wonder how the IRS Tax Refund 2026 may interact with their Social Security payments. In most cases, receiving the IRS Tax Refund 2026 does not reduce Social Security retirement or disability benefits. These programs operate independently, meaning taxpayers can receive both payments without affecting eligibility.

Social Security retirement and disability benefits follow a predictable monthly schedule based on birth dates. Meanwhile, the IRS Tax Refund 2026 is issued only after a taxpayer files a return and the government verifies eligibility. Understanding this difference helps individuals avoid confusion when monitoring bank deposits during tax season.

For beneficiaries who rely heavily on fixed monthly income, the IRS Tax Refund 2026 can provide valuable financial relief. It may help cover unexpected expenses, home maintenance costs, or medical bills that Social Security benefits alone may not fully support.

Birth-Date Payment System and Financial Planning with IRS Tax Refund 2026

The Social Security Administration distributes monthly benefits according to a structured birth-date schedule. People born between the first and tenth of the month typically receive benefits on the second Wednesday. Those born between the eleventh and twentieth receive payments on the third Wednesday, while individuals born later in the month receive payments on the fourth Wednesday.

Taxpayers expecting the IRS Tax Refund 2026 often plan their budgets around this payment system. By aligning their expected refund timeline with Social Security deposits, families can manage rent, utilities, groceries, and healthcare expenses more efficiently.

Individuals who began receiving Social Security benefits before May 1997 typically receive payments at the beginning of the month. For these recipients, the IRS Tax Refund 2026 can serve as additional financial support during months when unexpected expenses arise.

IRS Tax Refund 2026 and Disability Benefit Recipients

Recipients of Social Security Disability Insurance also pay close attention to the IRS Tax Refund 2026. SSDI payments generally follow the same birth-date schedule as retirement benefits, making it easier for beneficiaries to track monthly income. When combined with the IRS Tax Refund 2026, disability recipients often gain greater financial flexibility.

Some individuals receive both SSDI and Supplemental Security Income. SSI payments are usually issued on the first day of the month, while the IRS Tax Refund 2026 arrives separately after tax return processing. These separate payment systems are designed to ensure continuous financial support without interruption.

The IRS Tax Refund 2026 can be especially important for disability recipients who face higher healthcare expenses. Many individuals use refunds to purchase medical equipment, cover prescription costs, or improve home accessibility.

Rumors, Stimulus Discussions, and IRS Tax Refund 2026

During tax season, online discussions often create confusion about additional government payments connected to the IRS Tax Refund 2026. As of now, there is no confirmed nationwide stimulus program scheduled alongside the IRS Tax Refund 2026. Any new stimulus payment would require approval from the United States Congress and an official government announcement.

Taxpayers should rely only on verified government sources when tracking updates related to the IRS Tax Refund 2026. Social media rumors can lead to unrealistic expectations and financial planning mistakes. Checking official updates ensures taxpayers receive accurate information about refund eligibility and payment timelines.

Cost of Living Adjustments and Their Influence on IRS Tax Refund 2026

Cost of Living Adjustments are designed to help Social Security beneficiaries keep up with inflation. Although COLA increases do not directly impact the IRS Tax Refund 2026, they can influence overall household income and financial planning strategies.

Many taxpayers use the IRS Tax Refund 2026 alongside COLA-adjusted Social Security payments to balance their budgets. The combination of slightly higher monthly benefits and a one-time refund can help households manage rising costs for housing, food, and healthcare.

However, the amount of the IRS Tax Refund 2026 varies for each taxpayer. Income levels, tax credits, filing status, and deductions all affect the final refund amount.

Medicare Deductions and How They Affect Financial Planning with IRS Tax Refund 2026

Some Social Security recipients notice that their monthly deposits appear smaller due to Medicare premium deductions. These deductions do not directly affect the IRS Tax Refund 2026, but they can influence how beneficiaries use their refund.

Many taxpayers rely on the IRS Tax Refund 2026 to offset healthcare costs that Medicare may not fully cover. Reviewing annual benefit statements helps individuals understand their gross benefit amount, deductions, and final deposit totals. This understanding helps families plan how to allocate their refund more effectively.

Checking IRS Tax Refund 2026 Status and Staying Secure

Taxpayers can track the IRS Tax Refund 2026 through official online tracking tools. These systems allow individuals to monitor refund approval, processing, and payment status. Direct deposit remains the fastest and safest way to receive the IRS Tax Refund 2026, reducing the risk of lost or delayed checks.

Security is also an essential part of the IRS Tax Refund 2026 process. Scams often increase during tax season, with fraudsters attempting to obtain personal information by posing as government representatives. Taxpayers should remember that the IRS does not request personal information through unexpected phone calls, emails, or text messages.

Protecting Social Security numbers, banking details, and tax records ensures taxpayers receive their IRS Tax Refund 2026 without complications.

Financial Planning Tips Using IRS Tax Refund 2026

Many financial experts recommend using the IRS Tax Refund 2026 wisely rather than treating it as bonus spending money. Creating a financial plan before receiving the refund can help maximize its benefits. Some common strategies include paying off high-interest debt, building emergency savings, investing in education, or handling necessary home repairs.

The IRS Tax Refund 2026 can also provide an opportunity for long-term financial improvement. Families who use their refunds strategically often reduce financial stress and improve stability throughout the year.

Final Thoughts on IRS Tax Refund 2026

The IRS Tax Refund 2026 plays a critical role in supporting millions of American households during tax season. While Social Security and disability benefits provide steady monthly income, the IRS Tax Refund 2026 offers additional financial support that can help families manage large or unexpected expenses.

Understanding how the refund process works, how it aligns with Social Security payment schedules, and how to track refund status can reduce stress and improve financial planning. The structured processing system ensures taxpayers receive accurate refunds based on their eligibility and tax filing details.

By staying informed, filing returns accurately, and using refunds responsibly, taxpayers can make the most of the IRS Tax Refund 2026 and strengthen their overall financial stability.

Disclaimer:

This article is for informational purposes only and does not provide financial, tax, or legal advice. Refund amounts, eligibility, and payment timelines for IRS Tax Refund 2026 depend on individual tax situations and official government guidelines. Taxpayers should verify details through official IRS sources or consult a qualified tax professional for personalized assistance.